Assuring a solid future for Omaha's Jewish Community

The Jewish Federation of Omaha Foundation strives to assure the stability and continuity of Jewish life and support Jewish communal services. Your gift to The Foundation helps to provide a sound financial future for Omaha's Jewish community and fulfill your individual or family philanthropic goals.

Jewish Federation of Omaha Foundation offers simple tools to invest in high-impact community initiatives that meet immediate as well as long-term needs.

Whether you are adding to your existing fund at The Foundation or establishing a new one, your priorities become our priorities.

Please call me directly at 402-334-6466. I look forward to hearing from you.

Amy Bernstein Shivvers

Amy Bernstein Shivvers

Executive Director

ashivvers@jewishomaha.org

402-334-6466

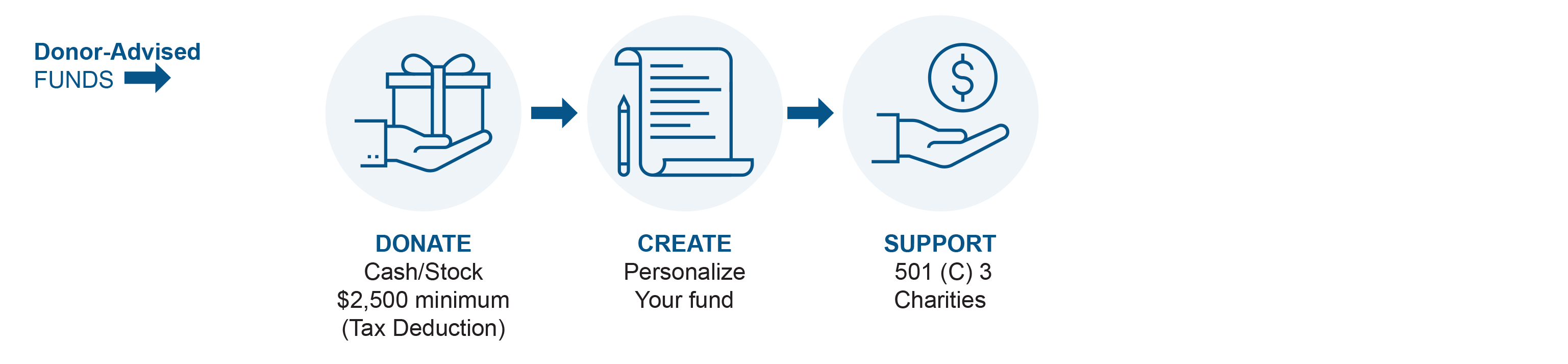

Your PHILANTHROPIC Journey

Our 2024 IMPACT