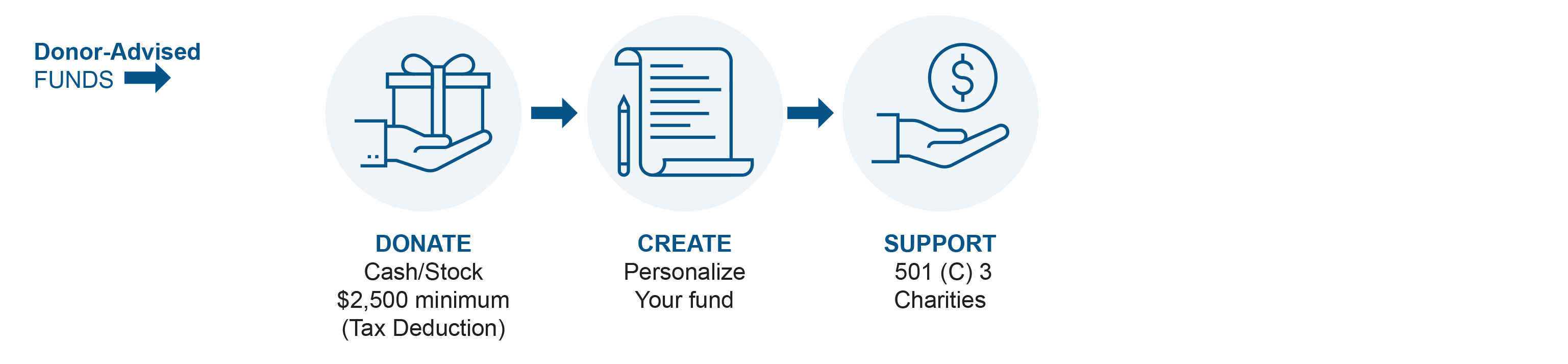

Click on the above image for our Donor Advised Fund Basics Video.

Are simple, tax-smart investment opportunities for charitable giving. It works like a personal, charitable checking account at The Foundation. You contribute cash, securities, or other appreciated assets; you may be eligible for a current year tax deduction, and you can be more strategic about your giving decisions. You recommend all distributions during your lifetime and leave the remainder to your children, grandchildren or to The Foundation for distribution after your death as part of your legacy.

“For as little as $2,500, you can open a Donor-Advised Fund. It’s an efficient and time-saving way to make campaign gifts and donations in the Jewish or general community.”

“For as little as $2,500, you can open a Donor-Advised Fund. It’s an efficient and time-saving way to make campaign gifts and donations in the Jewish or general community.”

- Jeff Kirshenbaum

“I’ve enjoyed my donor-advised fund and wish we had opened it many years earlier. The structure allows for more thoughtful philanthropy and donating throughout the year rather than at the year’s end. I appreciate the central recordkeeping and ease in sending donations. I can do year-end tax planning and schedule fund contributions separate from charitable giving. A simple email to one of the fund administrators at The Foundation gets the ball rolling and the donation is sent. Very easy and efficient.”

“I’ve enjoyed my donor-advised fund and wish we had opened it many years earlier. The structure allows for more thoughtful philanthropy and donating throughout the year rather than at the year’s end. I appreciate the central recordkeeping and ease in sending donations. I can do year-end tax planning and schedule fund contributions separate from charitable giving. A simple email to one of the fund administrators at The Foundation gets the ball rolling and the donation is sent. Very easy and efficient.”

- Dr. Eric Phillips

“During my teenage years, I established a Tzedek Teen Account at The Foundation. Recently, I transferred the balance to set up a Donor-Advised Fund there. Now that I’m employed, I can contribute to replenish the fund and recommend grants to various Jewish and secular non-profits across the U.S. The online portal makes it easy to support organizations and causes I believe in. Additionally, I’ve arranged for an automated monthly donation to support Pay It Forward, a fund created by The Foundation to help Jewish youth participate in programming, education, and camp. It’s incredibly rewarding, and even a small amount, starting from $10, can make a significant difference.”

“During my teenage years, I established a Tzedek Teen Account at The Foundation. Recently, I transferred the balance to set up a Donor-Advised Fund there. Now that I’m employed, I can contribute to replenish the fund and recommend grants to various Jewish and secular non-profits across the U.S. The online portal makes it easy to support organizations and causes I believe in. Additionally, I’ve arranged for an automated monthly donation to support Pay It Forward, a fund created by The Foundation to help Jewish youth participate in programming, education, and camp. It’s incredibly rewarding, and even a small amount, starting from $10, can make a significant difference.”

- Benjamin Brodkey

For more information, call Amy Bernstein Shivvers at 402-334-6466.